Getting The Pkf Advisory Services To Work

Getting The Pkf Advisory Services To Work

Blog Article

Pkf Advisory Services Things To Know Before You Get This

Table of ContentsPkf Advisory Services for DummiesFacts About Pkf Advisory Services UncoveredNot known Details About Pkf Advisory Services Pkf Advisory Services Things To Know Before You BuyThe Ultimate Guide To Pkf Advisory Services

Recognizing that you have a strong financial plan in position and specialist guidance to turn to can lower anxiousness and boost the lifestyle for lots of. Expanding accessibility to economic advice can additionally play an essential role in reducing wealth inequality at a social degree. Typically, those with reduced earnings would profit the most from financial guidance, but they are likewise the least likely to afford it or know where to seek it out.Typical monetary guidance versions normally served wealthier people in person. Designs of financial suggestions are currently typically hybrid, and some are also digital-first.

The Only Guide to Pkf Advisory Services

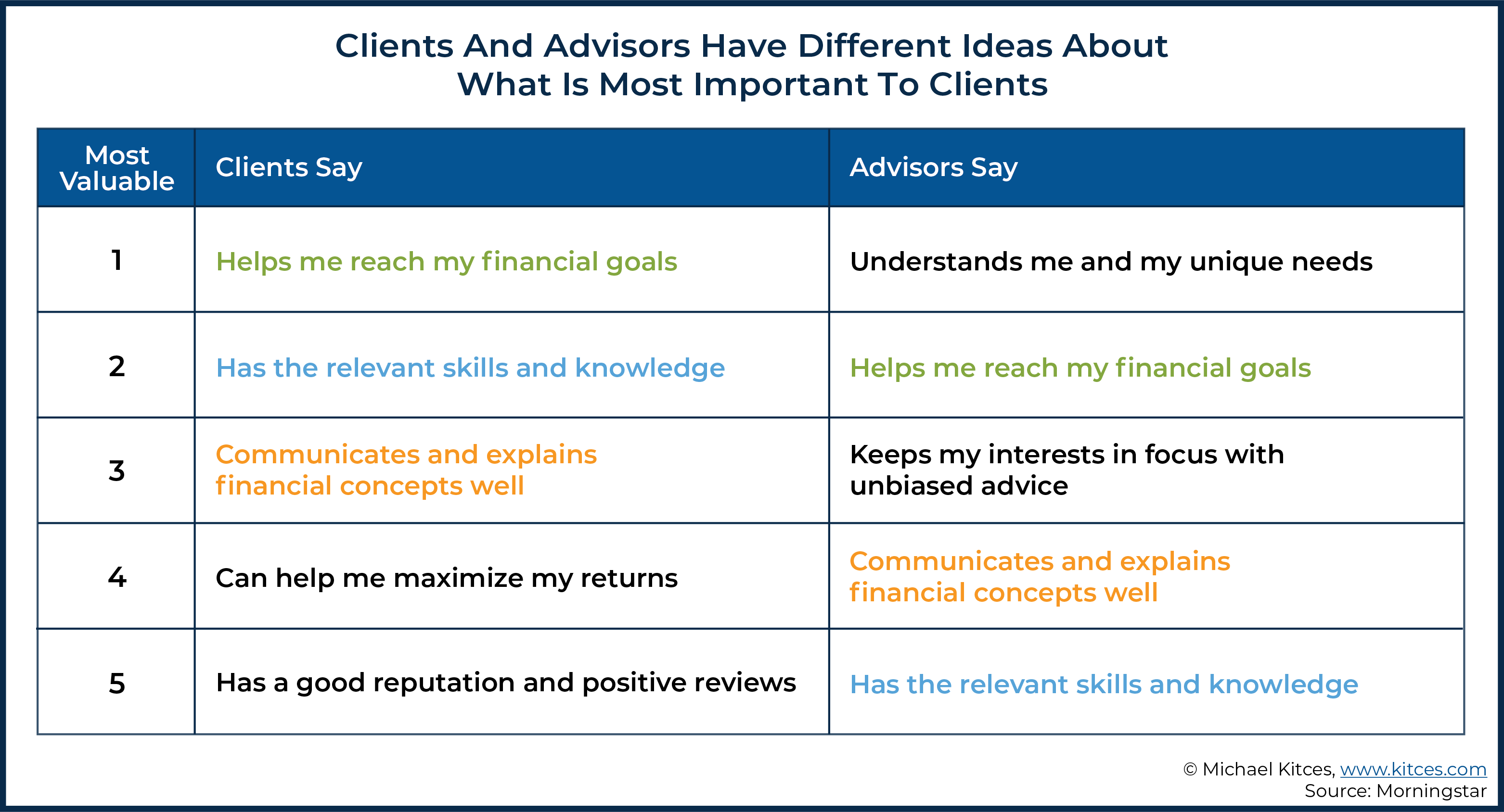

There is now an evolving breadth of suggestions models with a series of rates structures to match a gradient of client demands. One more substantial barrier is an absence of rely on monetary advisors and the recommendations they provide. In Europe, 62% of the grown-up populace is not confident that the investment recommendations they receive from their bank, insurance company, or financial advisor is in their ideal interest.

The future described right here is one where monetary health is accessible for all. It is a future where financial recommendations is not a deluxe yet an important solution easily accessible to every person. The advantages of such a future are far-reaching, yet we have a lengthy method to go to reach this vision.

Marital relationship, separation, remarriage or just relocating with a brand-new companion are all turning points that can require cautious planning. Along with the frequently challenging emotional ups and downs of separation, both companions will certainly have to deal with crucial monetary considerations. Will you have enough income to sustain your way of living? Exactly how will your investments and various other possessions be separated? You may quite possibly need to alter your financial method to keep your goals on course, Lawrence claims.

An unexpected influx of cash money or possessions elevates instant questions about what to do with it. "A financial consultant can help you analyze the ways you can put that cash to work towards your personal and financial objectives," Lawrence says. You'll desire to think of exactly how much might go to paying for existing debt and just how much you might consider spending to go after a more safe and secure future.

Facts About Pkf Advisory Services Uncovered

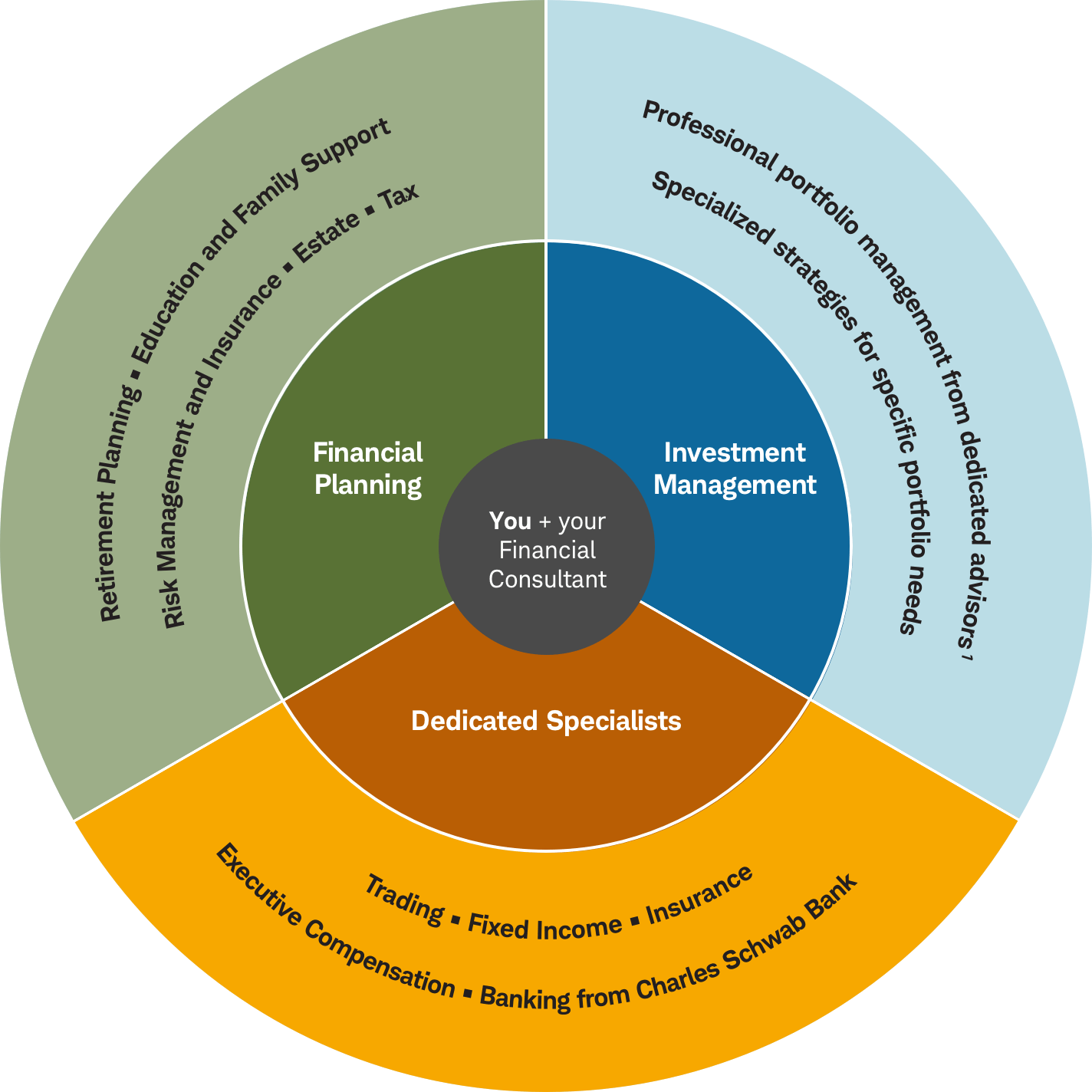

No 2 individuals will have rather the very same collection of investment methods or remedies. Depending on your goals in addition to your resistance for danger and the moment you need to pursue those goals, your expert can help you identify a mix of investments that are suitable for you and developed to assist you reach them.

During these conversations, voids in existing techniques can be determined. A vital advantage of developing a plan is having a detailed sight of your economic scenario. When you can see the whole photo, it's much easier to see what's missing. When life adjustments and you struck a bump on your economic roadmap, it's very easy to leave track.

Unknown Facts About Pkf Advisory Services

Will I have enough conserved for retired life? How will I afford to send my kids to university? Will I ever have sufficient money to take a trip the world? As soon as the doubt sets in, the inquiries begin to expand. An extensive, written strategy gives you a clear image and direction for means to reach your goals.

It is therefore not unexpected that amongst the respondents in our 2023 T. Rowe Rate Retired Life Cost Savings and Investing Study, 64% of infant boomers reported moderate to high degrees of stress and anxiety about their retired life financial savings. When getting ready for retired life, individuals may take advantage of instructional resources and electronic experiences to aid them compose a formal strategy that details anticipated expenses, revenue, and possession monitoring techniques.

Producing an official written plan for retirement has shown some important advantages for preretirees, consisting of increasing their confidence and enjoyment concerning retired life. Most of our preretiree survey respondents were either in the process of developing blog here a retirement or thinking regarding it. For preretirees that were within five years of navigate to these guys retirement and for retired people in the five years after their retired life day, information revealed a significant rise in official retired life preparation, including seeking assistance from a monetary consultant (Fig.

An Unbiased View of Pkf Advisory Services

Preretirees may find worth in a range of services that will certainly assist them plan for retired life. These can consist of specialized education to aid with the withdrawal and income stage or with vital decisions such as when to accumulate Social Safety.

Report this page